FanDuel Stops Accepting Credit Card Deposits — What Now?

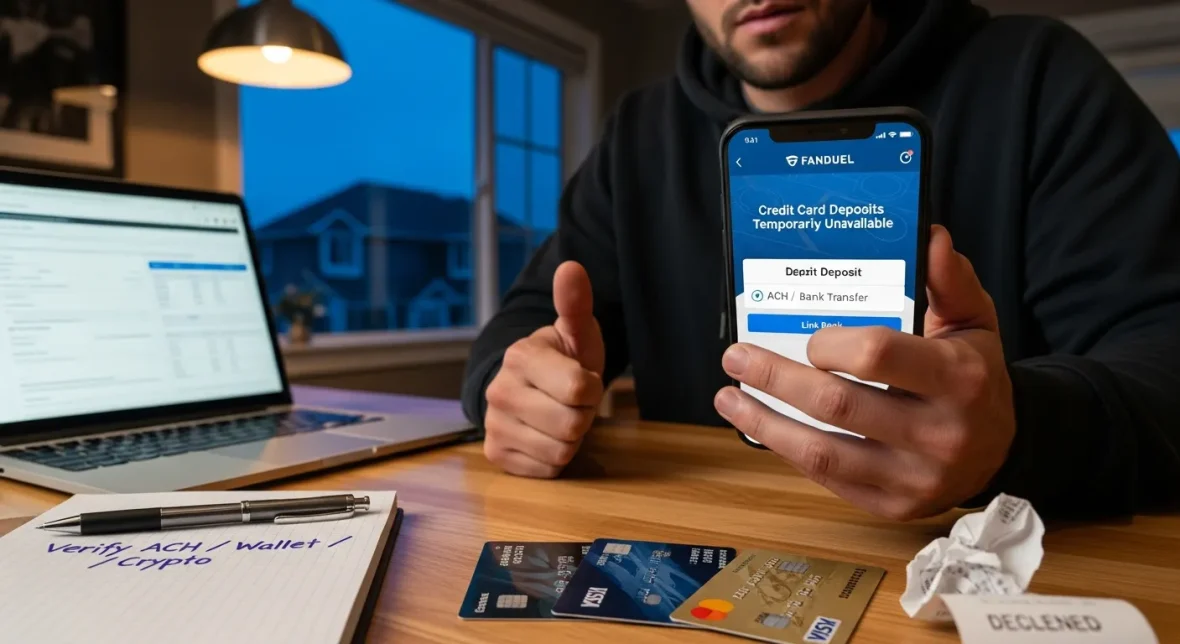

You likely opened your FanDuel app this week and found the familiar credit card option missing at checkout. That change matters if you move money quickly, hedge positions, or routinely fund daily fantasy and sportsbook activity with plastic. As someone who follows payments, crypto, and market shifts closely, I’ll walk you through what happened, why it matters for your wallet and portfolio, and practical ways to keep wagering or managing exposure without a credit card. This isn’t a cheer for disorder, it’s a practical guide so you can act fast and avoid surprises.

Key Takeaways

- FanDuel no longer taking credit card deposits means credit-card rails were disabled across most states, so stop relying on instant card funding for last-minute bets or hedges.

- Link and verify your bank account (use instant ACH verification if available) to restore fast deposits—expect standard ACH to clear in 1–3 business days when instant options fail.

- Consider vetted prepaid cards or third-party wallets for speed but check state availability and fees, since issuers may still block gambling-category transactions.

- If you use crypto, convert on a regulated exchange to fiat and withdraw to your bank before depositing to FanDuel, and keep conversion records for tax and compliance.

- Protect your account by enabling two-factor authentication, monitoring transactions, and watching FanDuel support pages and state regulator notices for evolving deposit rules.

What Changed And When

FanDuel recently removed the option to deposit with major credit cards across most states where it operates. The change rolled out quietly over a few days, first flagged by users on social channels and then confirmed on FanDuel’s help pages. You should note two key facts: first, existing recurring credit card rails for automatic deposits were disabled in short order: second, FanDuel didn’t block all card-based payments, some third-party processors and prepaid card flows still work inconsistently.

Key Dates And Timeline Of Changes

The shift began in late January and became widely noticeable in early February when customer service tickets spiked. FanDuel updated its support documentation within a week and started directing new deposit flows to bank transfers and other methods.

Official Statements And Sources To Monitor

FanDuel issued a short notice explaining the change as a response to evolving payment practices and regulatory guidance. For real-time updates, watch FanDuel’s dedicated support pages, state gaming commission notices, and filings from major card networks. I’d also follow industry reporters and payments trade sites, they often spot subtle policy updates before platforms publish them.

Why FanDuel Stopped Accepting Credit Card Deposits

There are several practical reasons behind the move. Card networks and issuing banks have been tightening rules around gambling-related transactions. From your perspective as an investor or operator of financial flows, credit-card-backed deposits pose chargeback risk and regulatory scrutiny. FanDuel faces both: the cost of disputes and the compliance burden of monitoring for problem gambling and anti-money-laundering rules when funds move instantly via cards.

Card Issuer And Bank Restrictions

Major issuers increasingly label or block gambling payments, and banks flag unusual activity to limit fraud and losses. That means FanDuel has to contend with declining reliability of card rails. If you’ve used a credit card for small, frequent deposits, expect higher friction going forward: more declines, holds, or even retroactive reversals if a card issuer decides a charge violates their policies.

Immediate Impact On Users

You’ll feel the change in places that matter: funding speed, flexibility, and short-term liquidity. If you keep margin-like positions across derivatives or hedge through multiple accounts, losing instant card funding complicates rapid moves.

Short-Term User Disruptions

Expect deposit failures, longer wait times for funds to clear, and an uptick in support requests. Some users who rely on card-based rewards or miles will lose that ancillary benefit. If you were using a card’s promotional period to float funds, you’ll need to reconsider cash flow and interest exposure.

Longer-Term Market And Consumer Effects

Over time, this could push users toward bank transfers, prepaid cards, third-party wallets, or crypto. That shift changes the fee profile, privacy characteristics, and settlement timing of your transactions. For businesses in the payments chain, it means new partnerships and product changes. For you as an investor, it’s a signal that payment rails for wagering are evolving: companies that adapt quickly will have an edge.

Alternative Deposit Methods For FanDuel Accounts

FanDuel still supports a handful of deposit options that you can use instead of credit cards. Each comes with tradeoffs so you should pick the one that matches your priorities: speed, cost, or privacy.

Bank Transfers (ACH) And E‑Checks

ACH transfers are widely supported and reliable, but they’re not instant in all cases. If you link your bank account, deposits generally clear in one to three business days, though some banks and FanDuel offer near-instant ACH for verified accounts. ACH has low fees and low dispute risk compared with cards.

Prepaid Cards And Gift Cards

Prepaid debit cards sometimes still work for deposits, but they can be hit-or-miss. Issuers may block gambling categories, and limits are often low. They’re useful if you want to cap spending, though you’ll lose card benefits like purchase protection.

Third-Party Payment Services And Wallets

Some third-party wallets and payment services remain available depending on your state. These move faster than ACH in many instances but often carry fees and additional identity checks. Check FanDuel’s deposit page in your account to see which wallets are active for you.

How Cryptocurrency Fits In As An Alternative

If you follow Cryptsy and similar services, you know crypto offers a distinct path for moving value into gaming accounts. FanDuel hasn’t officially turned into a crypto-first platform, but crypto can play a role for users who prioritize speed and privacy.

Supported Cryptocurrencies And Conversion Options

FanDuel doesn’t accept direct crypto deposits in most jurisdictions today, but third-party services let you convert crypto to fiat and route it into your account. Stablecoins converted through exchanges can minimize volatility during the transfer.

Speed, Fees, And Privacy Tradeoffs

Crypto routes can be fast, especially when using stablecoins and on-chain transfers with reasonable fees. But you’ll face conversion fees and potential tax-reporting complexities. From a privacy standpoint, crypto changes the trail but does not remove KYC requirements when funds enter regulated platforms. If you’re thinking about using crypto, factor conversion costs and local tax rules into your decision.

Practical Steps For Depositing Without A Credit Card

You don’t need to panic. There are clear, step-by-step actions that let you keep funding accounts and managing risk.

Step-By-Step: Linking A Bank Account Or ACH

Start by verifying your bank in the FanDuel app. Use micro-deposit verification if offered. Choose consent for instant verification where available, that often gives you near-instant deposit capability. If instant verification fails, plan for a one- to three-business-day window for ACH.

Step-By-Step: Using Prepaid Or Third-Party Wallets

If you prefer a prepaid lane, buy a reputable reloadable debit card from a bank or major issuer and register it to your FanDuel account. For wallets, create an account with a supported provider, complete identity checks, and move funds into that wallet before depositing. Always confirm the wallet-to-FanDuel flow in your account settings.

Step-By-Step: Converting Crypto To Fiat For Deposit

If you hold crypto, move coins to a regulated exchange that supports fiat withdrawals. Convert crypto to USD or another supported currency, withdraw to your linked bank account, and then initiate a deposit from your bank to FanDuel. Expect at least a day for settlements, depending on exchange and bank processes. Keep records of the conversion for tax reporting, this is important if you trade sizable amounts.

Regulatory, Security, And Responsible-Gambling Considerations

You should treat these deposit changes through the lens of compliance and security. Regulators are watching payment flows into gaming closely, and companies like FanDuel must show strong anti-money-laundering controls and safe-gambling measures.

How To Protect Your Funds And Account

Use strong, unique passwords and enable two-factor authentication on your FanDuel account and your linked bank or wallet. Monitor transaction histories daily when you first change deposit methods. If a deposit stalls, open a support ticket and document timestamps and reference numbers. For larger transfers, consider wiring funds with clear provenance documentation.

State-By-State Regulatory Variations To Watch

Rules vary by state. Some jurisdictions have stricter limits on funding sources or special reporting obligations. If you’re active across multiple states, be aware that deposit options available to you in one state might be blocked in another. Keep an eye on notices from your state gaming commission and FanDuel’s state-specific help pages.

Conclusion

The removal of credit card deposits at FanDuel is a meaningful shift in how consumers move money into gaming and fantasy accounts. It’s driven by a mix of issuer policy, regulatory caution, and risk management. For you, the right response is practical: verify a bank account for ACH, consider vetted third-party wallets if speed matters, and treat crypto as a tool that requires extra steps and record-keeping. From an investment standpoint, this change signals payment friction that could modestly reshape user behavior and the economics of gaming platforms. Keep watching official notices and your account settings, and adjust cash-flow plans accordingly.

Fantasy picks, DFS, betting tips: Ride Jakucionis’s hot shooting, pay up for Cunningham André Snellings and Eric Moody

DraftKings CEO Says Calls to Ban Prop Bets Are ‘Crazy’

You’ll still find the same markets and player props whether you fund with a card or bank transfer, but your timing matters more now. If you make lineup moves late, ensure funds are cleared first. And while industry leaders debate prop-bet rules, your best practice remains the same: use reliable deposit methods, protect your accounts, and factor the new settlement timing into any last-minute roster or bet decisions.

Frequently Asked Questions

Why is FanDuel no longer taking credit card deposits?

FanDuel stopped accepting credit card deposits mainly because card networks and issuers tightened rules on gambling transactions, increasing chargeback risk and compliance burdens. The change reduces dispute costs and helps FanDuel meet anti-money-laundering and responsible-gambling requirements.

When did FanDuel remove the credit card deposit option and how was it announced?

The removal began in late January and became widely visible in early February, flagged by users and later reflected in FanDuel’s support pages. FanDuel posted a short notice and updates appeared on state gaming commission pages and industry trade sites.

What are the best alternatives to credit card deposits on FanDuel?

Use ACH/bank transfers for low fees and reliability, prepaid or reloadable debit cards to cap spending, or supported third-party wallets for faster transfers. Crypto-to-fiat conversions are possible via exchanges but require extra steps, conversion fees, and tax record-keeping.

How does this change affect deposit speed and short-term betting strategies?

Losing instant credit-card funding can delay deposits, complicating last-minute lineup moves or hedges. ACH often takes 1–3 business days unless instant verification is available; third-party wallets or verified bank instant ACH offer quicker alternatives but may carry fees or identity checks.

Can I still use a credit or debit prepaid card to deposit on FanDuel?

Prepaid debit cards sometimes still work, but results vary by issuer and state. Many issuers block gambling categories and limits can be low. If you choose this route, register the card to your FanDuel account and confirm the card type is accepted in your state before relying on it.